About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 45 results price clear

A Multi-Agent Simulation Approach to Farmland Auction Markets

James Nolan | Published Wednesday, June 22, 2011 | Last modified Saturday, April 27, 2013This model explores the effects of agent interaction, information feedback, and adaptive learning in repeated auctions for farmland. It gathers information for three types of sealed-bid auctions, and one English auction and compares the auctions on the basis of several measures, including efficiency, price information revelation, and ability to handle repeated bidding and agent learning.

Adoption of conservation practices

Irem Daloglu | Published Monday, October 21, 2013This model is designed to investigate the impact of alternative policy approaches and changing land tenure dynamics on farmer adoption of conservation practices intended to increase the water quality.

The Agent-Based Model of the Closed Market( similar to Stock Market) with One Commodity and with careful and risky mechanisms

Mark Voronovitsky | Published Sunday, March 15, 2015 | Last modified Sunday, March 22, 2015The model of market of one commodity , in which there are in each moment of time the same quantity and the same quantity of money was formulated and researched in this text. We also study this system as a game of automata.

Endogenous Dynamics of Housing Market Cycles

Birnur Özbaş Onur Özgün Yaman Barlas | Published Monday, September 09, 2013 | Last modified Wednesday, January 08, 2014The purpose of this model is to analyze the dynamics of endogenously created oscillations in housing prices using a system dynamics simulation model, built from the perspective of construction companies.

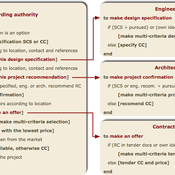

Enhancing recycling of construction materials; an agent based model with empirically based decision parameters

Christof Knoeri Igor Nikolic Hans-Joerg Althaus Claudia Binder | Published Sunday, October 21, 2012 | Last modified Monday, June 09, 2014This model allows for analyzing the most efficient levers for enhancing the use of recycled construction materials, and the role of empirically based decision parameters.

01a ModEco V2.05 – Model Economies – In C++

Garvin Boyle | Published Monday, February 04, 2013 | Last modified Friday, April 14, 2017Perpetual Motion Machine - A simple economy that operates at both a biophysical and economic level, and is sustainable. The goal: to determine the necessary and sufficient conditions of sustainability, and the attendant necessary trade-offs.

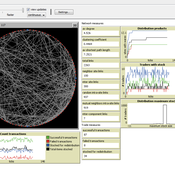

MERCURY: an ABM of tableware trade in the Roman East

Tom Brughmans Jeroen Poblome | Published Thursday, September 25, 2014 | Last modified Friday, May 01, 2015MERCURY aims to represent and explore two descriptive models of the functioning of the Roman trade system that aim to explain the observed strong differences in the wideness of distributions of Roman tableware.

An Agent-Based Model of Internet Diffusion Under General and Specific Network Externalities

Filiz Garip | Published Friday, April 27, 2012 | Last modified Saturday, April 27, 2013Using nodes from the 2002 General Social Survey sample, the code establishes a network of ties with a given homophily bias, and simulates Internet adoption rates in that network under three conditions: (i) no network externalities, (ii) general network externalities, where an individual’s reservation price is a function of the overall adoption rate in the network, (iii) specific network externalities, where reservation price is a function of the adoption rate in individual’s personal […]

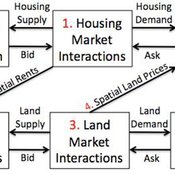

Coupled Housing and Land Markets (CHALMS)

Nicholas Magliocca Virginia Mcconnell Margaret Walls | Published Friday, November 02, 2012 | Last modified Monday, October 27, 2014CHALMS simulates housing and land market interactions between housing consumers, developers, and farmers in a growing ex-urban area.

Alternative scenarios of green consumption in Italy: an empirically grounded model.

Giangiacomo Bravo Elena Vallino Alessandro K Cerutti Maria Beatrice Pairotti | Published Thursday, March 28, 2013 | Last modified Saturday, April 27, 2013We provide a full description of the model following the ODD protocol (Grimm et al. 2010) in the attached document. The model is developed in NetLogo 5.0 (Wilenski 1999).

Displaying 10 of 45 results price clear