About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 4 of 4 results housing transactions clear

Demography, Industry and Residential Choice (DIReC) model

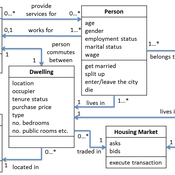

Jiaqi Ge | Published Wednesday, September 04, 2019The integrated and spatially-explicit ABM, called DIReC (Demography, Industry and Residential Choice), has been developed for Aberdeen City and the surrounding Aberdeenshire (Ge, Polhill, Craig, & Liu, 2018). The model includes demographic (individual and household) models, housing infrastructure and occupancy, neighbourhood quality and evolution, employment and labour market, business relocation, industrial structure, income distribution and macroeconomic indicators. DIReC includes a detailed spatial housing model, basing preference models on house attributes and multi-dimensional neighbourhood qualities (education, crime, employment etc.).

The dynamic ABM simulates the interactions between individuals, households, the labour market, businesses and services, neighbourhoods and economic structures. It is empirically grounded using multiple data sources, such as income and gender-age distribution across industries, neighbourhood attributes, business locations, and housing transactions. It has been used to study the impact of economic shocks and structural changes, such as the crash of oil price in 2014 (the Aberdeen economy heavily relies on the gas and oil sector) and the city’s transition from resource-based to a green economy (Ge, Polhill, Craig, & Liu, 2018).

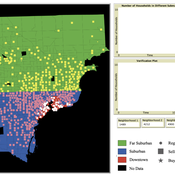

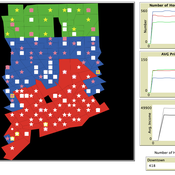

While the world’s total urban population continues to grow, not all cities are witnessing such growth, some are actually shrinking. This shrinkage causes several problems to emerge including population loss, economic depression, vacant properties and the contraction of housing markets. Such problems challenge efforts to make cities sustainable. While there is a growing body of work on study shrinking cities, few explore such a phenomenon from the bottom up using dynamic computational models. To overcome this issue this paper presents an spatially explicit agent-based model stylized on the Detroit Tri-county area, an area witnessing shrinkage. Specifically, the model demonstrates how through the buying and selling of houses can lead to urban shrinkage from the bottom up. The model results indicate that along with the lower level housing transactions being captured, the aggregated level market conditions relating to urban shrinkage are also captured (i.e., the contraction of housing markets). As such, the paper demonstrates the potential of simulation to explore urban shrinkage and potentially offers a means to test polices to achieve urban sustainability.

Exploring Urban Shrinkage

Andrew Crooks | Published Thursday, March 19, 2020While the world’s total urban population continues to grow, this growth is not equal. Some cities are declining, resulting in urban shrinkage which is now a global phenomenon. Many problems emerge due to urban shrinkage including population loss, economic depression, vacant properties and the contraction of housing markets. To explore this issue, this paper presents an agent-based model stylized on spatially explicit data of Detroit Tri-county area, an area witnessing urban shrinkage. Specifically, the model examines how micro-level housing trades impact urban shrinkage by capturing interactions between sellers and buyers within different sub-housing markets. The stylized model results highlight not only how we can simulate housing transactions but the aggregate market conditions relating to urban shrinkage (i.e., the contraction of housing markets). To this end, the paper demonstrates the potential of simulation to explore urban shrinkage and potentially offers a means to test polices to alleviate this issue.

Risks and Hedonics in Empirical Agent-based land market (RHEA) model

Koen de Koning Tatiana Filatova | Published Monday, April 01, 2019RHEA aims to provide a methodological platform to simulate the aggregated impact of households’ residential location choice and dynamic risk perceptions in response to flooding on urban land markets. It integrates adaptive behaviour into the spatial landscape using behavioural theories and empirical data sources. The platform can be used to assess: how changes in households’ preferences or risk perceptions capitalize in property values, how price dynamics in the housing market affect spatial demographics in hazard-prone urban areas, how structural non-marginal shifts in land markets emerge from the bottom up, and how economic land use systems react to climate change. RHEA allows direct modelling of interactions of many heterogeneous agents in a land market over a heterogeneous spatial landscape. As other ABMs of markets it helps to understand how aggregated patterns and economic indices result from many individual interactions of economic agents.

The model could be used by scientists to explore the impact of climate change and increased flood risk on urban resilience, and the effect of various behavioural assumptions on the choices that people make in response to flood risk. It can be used by policy-makers to explore the aggregated impact of climate adaptation policies aimed at minimizing flood damages and the social costs of flood risk.