About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 46 results demand clear

3D Urban Traffic Simulator (ABM) in Unity

Sedar Olmez Obi Thompson Sargoni Alison Heppenstall Daniel Birks Annabel Whipp Ed Manley | Published Friday, January 22, 2021 | Last modified Monday, March 22, 2021The Urban Traffic Simulator is an agent-based model developed in the Unity platform. The model allows the user to simulate several autonomous vehicles (AVs) and tune granular parameters such as vehicle downforce, adherence to speed limits, top speed in mph and mass. The model allows researchers to tune these parameters, run the simulator for a given period and export data from the model for analysis (an example is provided in Jupyter Notebook).

The data the model is currently able to output are the following:

…

Peer reviewed Labor and environment in global value chains: An evolutionary policy study with a three-sector and two-region agent-based macroeconomic model

Lena Gerdes Bernhard Rengs Manuel Scholz-Wäckerle | Published Wednesday, December 22, 2021With this model, we investigate resource extraction and labor conditions in the Global South as well as implications for climate change originating from industry emissions in the North. The model serves as a testbed for simulation experiments with evolutionary political economic policies addressing these issues. In the model, heterogeneous agents interact in a self-organizing and endogenously developing economy. The economy contains two distinct regions – an abstract Global South and Global North. There are three interlinked sectors, the consumption good–, capital good–, and resource production sector. Each region contains an independent consumption good sector, with domestic demand for final goods. They produce a fictitious consumption good basket, and sell it to the households in the respective region. The other sectors are only present in one region. The capital good sector is only found in the Global North, meaning capital goods (i.e. machines) are exclusively produced there, but are traded to the foreign as well as the domestic market as an intermediary. For the production of machines, the capital good firms need labor, machines themselves and resources. The resource production sector, on the other hand, is only located in the Global South. Mines extract resources and export them to the capital firms in the North. For the extraction of resources, the mines need labor and machines. In all three sectors, prices, wages, number of workers and physical capital of the firms develop independently throughout the simulation. To test policies, an international institution is introduced sanctioning the polluting extractivist sector in the Global South as well as the emitting industrial capital good producers in the North with the aim of subsidizing innovation reducing environmental and social impacts.

Modeling Personal Carbon Trading with ABM

Roman Seidl | Published Friday, December 07, 2018 | Last modified Thursday, July 29, 2021A simulated approach for Personal Carbon Trading, for figuring out what effects it might have if it will be implemented in the real world. We use an artificial population with some empirical data from international literature and basic assumptions about heterogeneous energy demand. The model is not to be used as simulating the actual behavior of real populations, but a toy model to test the effects of differences in various factors such as number of agents, energy price, price of allowances, etc. It is important to adapt the model for specific countries as carbon footprint and energy demand determines the relative success of PCT.

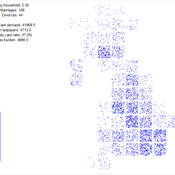

Social and Childcare Provision in Kinship Networks

Eric Silverman Umberto Gostoli | Published Thursday, October 21, 2021This model simulations social and childcare provision in the UK. Agents within simulated households can decide to provide for informal care, or pay for private care, for their loved ones after they have provided for childcare needs. Agents base these decisions on factors including their own health, employment status, financial resources, relationship to the individual in need and geographical location. This model extends our previous simulations of social care by simulating the impact of childcare demand on social care availability within households, which is known to be a significant constraint on informal care provision.

Results show that our model replicates realistic patterns of social and child care provision, suggesting that this framework can be a valuable aid to policy-making in this area.

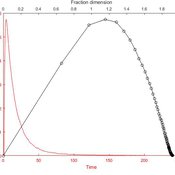

Simulating the cost of social care in an ageing population

Eric Silverman | Published Thursday, September 16, 2021This model is an agent-based simulation written in Python 2.7, which simulates the cost of social care in an ageing UK population. The simulation incorporates processes of population change which affect the demand for and supply of social care, including health status, partnership formation, fertility and mortality. Fertility and mortality rates are drawn from UK population data, then projected forward to 2050 using the methods developed by Lee and Carter 1992.

The model demonstrates that rising life expectancy combined with lower birthrates leads to growing social care costs across the population. More surprisingly, the model shows that the oft-proposed intervention of raising the retirement age has limited utility; some reductions in costs are attained initially, but these reductions taper off beyond age 70. Subsequent work has enhanced and extended this model by adding more detail to agent behaviours and familial relationships.

The version of the model provided here produces outputs in a format compatible with the GEM-SA uncertainty quantification software by Kennedy and O’Hagan. This allows sensitivity analyses to be performed using Gaussian Process Emulation.

Aqua.MORE

Lisa Huber Nico Bahro | Published Wednesday, November 20, 2019 | Last modified Saturday, July 03, 2021Aqua.MORE (Agent-based MOdelling of REsources in Socio-Hydrological Systems) is an agent based modelling (ABM) approach to simulate the resource flow and social interaction in a coupled natural and social system of water supply and demand. The model is able to simulate the two-way feedback as socio-economic agents influence the natural resource flow and the availability of this resource influences the agents in their behaviour.

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

The Coevolution of the Firm and the Product Attribute Space

Cesar Garcia-Diaz | Published Friday, May 22, 2020This model inspects the performance of firms as the product attribute space changes, which evolves as a consequence of firms’ actions. Firms may create new product variants by dragging demand from other existing variants. Firms decide whether to open new product variants, to invade existing ones, or to keep their variant portfolio. At each variant there is a Cournot competition each round. Competition is nested since many firms compete at many variants simultaneously, affecting firm composition at each location (variant).

After the Cournot outcomes, at each round firms decide whether to (i) keep their existing product variant niche, (ii) invade an existing variant, (iii) create a new variant, or (iv) abandon a variant. Firms’ profits across their niche take into consideration the niche-width cost and the cost of opening a new variant.

An agent-based model of building occupant behavior during load shedding

Handi Chandra Putra | Published Thursday, May 21, 2020Load shedding enjoys increasing popularity as a way to reduce power consumption in buildings during hours of peak demand on the electricity grid. This practice has well known cost saving and reliability benefits for the grid, and the contracts utilities sign with their “interruptible” customers often pass on substantial electricity cost savings to participants. Less well-studied are the impacts of load shedding on building occupants, hence this study investigates those impacts on occupant comfort and adaptive behaviors. It documents experience in two office buildings located near Philadelphia (USA) that vary in terms of controllability and the set of adaptive actions available to occupants. An agent-based model (ABM) framework generalizes the case-study insights in a “what-if” format to support operational decision making by building managers and tenants. The framework, implemented in EnergyPlus and NetLogo, simulates occupants that have heterogeneous

thermal and lighting preferences. The simulated occupants pursue local adaptive actions such as adjusting clothing or using portable fans when central building controls are not responsive, and experience organizational constraints, including a corporate dress code and miscommunication with building managers. The model predicts occupant decisions to act fairly well but has limited ability to predict which specific adaptive actions occupants will select.

A Pastoral Stoking Strategy Model with Fodder Import and Loan Scenarios

Yanbo Li | Published Tuesday, December 24, 2019This model was built to estimate the impacts of exogenous fodder input and credit loans services on livelihood, rangeland health and profits of pastoral production in a small holder pastoral household in the arid steppe rangeland of Inner Mongolia, China. The model simulated the long-term dynamic of herd size and structure, the forage demand and supply, the cash flow, and the situation of loan debt under three different stocking strategies: (1) No external fodder input, (2) fodders were only imported when natural disaster occurred, and (3) frequent import of external fodder, with different amount of available credit loans. Monte-Carlo method was used to address the influence of climate variability.

Displaying 10 of 46 results demand clear