About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 10 results Macroeconomic clear

An Agent Based Model of International Capital Flows

Harvey Baldovino | Published Thursday, April 06, 2023This is a preliminary attempt in creating an Agent-Based Model of capital flows. This is based on the theory of capital flows based on interest-rate differentials. Foreign capital flows to a country with higher interest rates relative to another. The model shows how capital volatilty and wealth concentration are affected by the speed of capital flow, number of investors, magnitude of changes in interest rate due to capital flows and the interest differential threshold that investors set in deciding whether to move capital or not. Investors in the model are either “regional” investors (only investing in neighboring countries) and “global” investors (those who invest anywhere in the world).

In the future, the author hopes to extend this model to incorporate capital flow based on changes in macroeconomic fundamentals, exchange rate volatility, behavioral finance (for instance, herding behavior) and the presence of capital controls.

Peer reviewed A Macroeconomic Model of a Closed Economy

Ian Stuart | Published Saturday, May 08, 2021 | Last modified Wednesday, June 23, 2021This model/program presents a “three industry model” that may be particularly useful for macroeconomic simulations. The main purpose of this program is to demonstrate a mechanism in which the relative share of labor shifts between industries.

Care has been taken so that it is written in a self-documenting way so that it may be useful to anyone that might build from it or use it as an example.

This model is not intended to match a specific economy (and is not calibrated to do so) but its particular minimalist implementation may be useful for future research/development.

…

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Florian Peters Doris Neuberger Oliver Reinhardt Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

Peer reviewed Labor and environment in global value chains: An evolutionary policy study with a three-sector and two-region agent-based macroeconomic model

Lena Gerdes Bernhard Rengs Manuel Scholz-Wäckerle | Published Wednesday, December 22, 2021With this model, we investigate resource extraction and labor conditions in the Global South as well as implications for climate change originating from industry emissions in the North. The model serves as a testbed for simulation experiments with evolutionary political economic policies addressing these issues. In the model, heterogeneous agents interact in a self-organizing and endogenously developing economy. The economy contains two distinct regions – an abstract Global South and Global North. There are three interlinked sectors, the consumption good–, capital good–, and resource production sector. Each region contains an independent consumption good sector, with domestic demand for final goods. They produce a fictitious consumption good basket, and sell it to the households in the respective region. The other sectors are only present in one region. The capital good sector is only found in the Global North, meaning capital goods (i.e. machines) are exclusively produced there, but are traded to the foreign as well as the domestic market as an intermediary. For the production of machines, the capital good firms need labor, machines themselves and resources. The resource production sector, on the other hand, is only located in the Global South. Mines extract resources and export them to the capital firms in the North. For the extraction of resources, the mines need labor and machines. In all three sectors, prices, wages, number of workers and physical capital of the firms develop independently throughout the simulation. To test policies, an international institution is introduced sanctioning the polluting extractivist sector in the Global South as well as the emitting industrial capital good producers in the North with the aim of subsidizing innovation reducing environmental and social impacts.

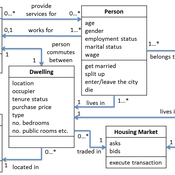

Demography, Industry and Residential Choice (DIReC) model

Jiaqi Ge | Published Wednesday, September 04, 2019The integrated and spatially-explicit ABM, called DIReC (Demography, Industry and Residential Choice), has been developed for Aberdeen City and the surrounding Aberdeenshire (Ge, Polhill, Craig, & Liu, 2018). The model includes demographic (individual and household) models, housing infrastructure and occupancy, neighbourhood quality and evolution, employment and labour market, business relocation, industrial structure, income distribution and macroeconomic indicators. DIReC includes a detailed spatial housing model, basing preference models on house attributes and multi-dimensional neighbourhood qualities (education, crime, employment etc.).

The dynamic ABM simulates the interactions between individuals, households, the labour market, businesses and services, neighbourhoods and economic structures. It is empirically grounded using multiple data sources, such as income and gender-age distribution across industries, neighbourhood attributes, business locations, and housing transactions. It has been used to study the impact of economic shocks and structural changes, such as the crash of oil price in 2014 (the Aberdeen economy heavily relies on the gas and oil sector) and the city’s transition from resource-based to a green economy (Ge, Polhill, Craig, & Liu, 2018).

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

Peer reviewed BAMERS: Macroeconomic effect of extortion

Alejandro Platas López Alejandro Guerra-Hernández | Published Monday, March 23, 2020 | Last modified Sunday, July 26, 2020Inspired by the European project called GLODERS that thoroughly analyzed the dynamics of extortive systems, Bottom-up Adaptive Macroeconomics with Extortion (BAMERS) is a model to study the effect of extortion on macroeconomic aggregates through simulation. This methodology is adequate to cope with the scarce data associated to the hidden nature of extortion, which difficults analytical approaches. As a first approximation, a generic economy with healthy macroeconomics signals is modeled and validated, i.e., moderate inflation, as well as a reasonable unemployment rate are warranteed. Such economy is used to study the effect of extortion in such signals. It is worth mentioning that, as far as is known, there is no work that analyzes the effects of extortion on macroeconomic indicators from an agent-based perspective. Our results show that there is significant effects on some macroeconomics indicators, in particular, propensity to consume has a direct linear relationship with extortion, indicating that people become poorer, which impacts both the Gini Index and inflation. The GDP shows a marked contraction with the slightest presence of extortion in the economic system.

MERCURY extension: population

Tom Brughmans | Published Thursday, May 23, 2019This model is an extended version of the original MERCURY model (https://www.comses.net/codebases/4347/releases/1.1.0/ ) . It allows for experiments to be performed in which empirically informed population sizes of sites are included, that allow for the scaling of the number of tableware traders with the population of settlements, and for hypothesised production centres of four tablewares to be used in experiments.

Experiments performed with this population extension and substantive interpretations derived from them are published in:

Hanson, J.W. & T. Brughmans. In press. Settlement scale and economic networks in the Roman Empire, in T. Brughmans & A.I. Wilson (ed.) Simulating Roman Economies. Theories, Methods and Computational Models. Oxford: Oxford University Press.

…

Peer reviewed Agent-based Renewables model for Integrated Sustainable Energy (ARISE)

Muhammad Indra Al Irsyad Anthony Halog Rabindra Nepal | Published Wednesday, November 29, 2017 | Last modified Friday, October 05, 2018ARISE is a hybrid energy model incorporating macroeconomic data, micro socio-economic data, engineering data and environmental data. This version of ARISE can simulate scenarios of solar energy policy for Indonesia case.

Peer reviewed Emergent Firms Model

J Applegate | Published Friday, July 13, 2018The Emergent Firm (EF) model is based on the premise that firms arise out of individuals choosing to work together to advantage themselves of the benefits of returns-to-scale and coordination. The Emergent Firm (EF) model is a new implementation and extension of Rob Axtell’s Endogenous Dynamics of Multi-Agent Firms model. Like the Axtell model, the EF model describes how economies, composed of firms, form and evolve out of the utility maximizing activity on the part of individual agents. The EF model includes a cash-in-advance constraint on agents changing employment, as well as a universal credit-creating lender to explore how costs and access to capital affect the emergent economy and its macroeconomic characteristics such as firm size distributions, wealth, debt, wages and productivity.