About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 29 results for 'Nicholas Mark Gotts'

Simulating Water, Individuals, and Management (SWIM)

John Murphy | Published Friday, July 05, 2019SWIM is a simulation of water management, designed to study interactions among water managers and customers in Phoenix and Tucson, Arizona. The simulation can be used to study manager interaction in Phoenix, manager and customer messaging and water conservation in Tucson, and when coupled to the Water Balance Model (U New Hampshire), impacts of management and consumer choices on regional hydrology.

Publications:

Murphy, John T., Jonathan Ozik, Nicholson T. Collier, Mark Altaweel, Richard B. Lammers, Alexander A. Prusevich, Andrew Kliskey, and Lilian Alessa. “Simulating Regional Hydrology and Water Management: An Integrated Agent-Based Approach.” Winter Simulation Conference, Huntington Beach, CA, 2015.

The Evolution of Tribalism: A Social-Ecological Model of Cooperation and Inter-group Conflict Under Pastoralism

Nicholas Seltzer | Published Monday, January 21, 2019This study investigates a possible nexus between inter-group competition and intra-group cooperation, which may be called “tribalism.” Building upon previous studies demonstrating a relationship between the environment and social relations, the present research incorporates a social-ecological model as a mediating factor connecting both individuals and communities to the environment. Cyclical and non-cyclical fluctuation in a simple, two-resource ecology drive agents to adopt either “go-it-alone” or group-based survival strategies via evolutionary selection. Novelly, this simulation employs a multilevel selection model allowing group-level dynamics to exert downward selective pressures on individuals’ propensity to cooperate within groups. Results suggest that cooperation and inter-group conflict are co-evolved in a triadic relationship with the environment. Resource scarcity increases inter-group competition, especially when resources are clustered as opposed to widely distributed. Moreover, the tactical advantage of cooperation in the securing of clustered resources enhanced selective pressure on cooperation, even if that implies increased individual mortality for the most altruistic warriors. Troubling, these results suggest that extreme weather, possibly as a result of climate change, could exacerbate conflict in sensitive, weather-dependent social-ecologies—especially places like the Horn of Africa where ecologically sensitive economic modalities overlap with high-levels of diversity and the wide-availability of small arms. As well, global development and foreign aid strategists should consider how plans may increase the value of particular locations where community resources are built or aid is distributed, potentially instigating tribal conflict. In sum, these factors, interacting with pre-existing social dynamics dynamics, may heighten inter-ethnic or tribal conflict in pluralistic but otherwise peaceful communities.

For special issue submission in JASSS.

Eliminating hepatitis C virus as a public health threat among HIV-positive men who have sex with men

Nick Scott Mark Stoove David P Wilson Olivia Keiser Carol El-Hayek Joseph Doyle Margaret Hellard | Published Wednesday, October 12, 2016 | Last modified Sunday, December 16, 2018We compare three model estimates for the time and treatment requirements to eliminate HCV among HIV-positive MSM in Victoria, Australia: a compartmental model; an ABM parametrized by surveillance data; and an ABM with a more heterogeneous population.

FEARLUS-SPOMM

Gary Polhill Nick Gotts Alistair Law Luis Izquierdio Alessandro Gimona Lee-Ann Sutherland Dawn Parker | Published Friday, March 25, 2016This is a coupled conceptual model of agricultural land decision-making and incentivisation and species metacommunities.

Peer reviewed Ideal Free Distribution of Mobile Pastoralists in the Logone Floodplain, Cameroon

Mark Moritz Ian M Hamilton Andrew Yoak Hongyang Pi Jeff Cronley Paul Maddock | Published Thursday, June 19, 2014 | Last modified Saturday, January 06, 2018The purpose of the model is to examine whether and how mobile pastoralists are able to achieve an Ideal Free Distribution (IFD).

Token Foraging in a Commons Dilemma

Nicholas Radtke | Published Monday, August 31, 2009 | Last modified Saturday, April 27, 2013The model aims to mimic the observed behavior of participants in spatially explicit dynamic commons experiments.

Simulating the Transmission of Foot-And-Mouth Disease Among Mobile Herds in the Far North Region, Cameroon

Hyeyoung Kim Ningchuan Xiao Mark Moritz Rebecca Garabed Laura W Pomeroy | Published Wednesday, April 13, 2016This model simulates movements of mobile pastoralists and their impacts on the transmission of foot-and-mouth disease (FMD) in the Far North Region of Cameroon.

Coastal Coupled Housing and Land Markets (C-CHALMS)

Nicholas Magliocca | Published Thursday, May 18, 2017Next generation of the CHALMS model applied to a coastal setting to investigate the effects of subjective risk perception and salience decision-making on adaptive behavior by residents.

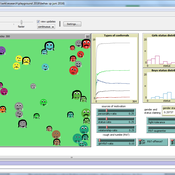

THE STATUS ARENA

Gert Jan Hofstede Jillian Student Mark R Kramer | Published Wednesday, June 08, 2016 | Last modified Tuesday, January 09, 2018Status-power dynamics on a playground, resulting in a status landscape with a gender status gap. Causal: individual (beauty, kindness, power), binary (rough-and-tumble; has-been-nice) or prior popularity (status). Cultural: acceptability of fighting.

The Agent-Based Model of the Closed Market( similar to Stock Market) with One Commodity and with careful and risky mechanisms

Mark Voronovitsky | Published Sunday, March 15, 2015 | Last modified Sunday, March 22, 2015The model of market of one commodity , in which there are in each moment of time the same quantity and the same quantity of money was formulated and researched in this text. We also study this system as a game of automata.

Displaying 10 of 29 results for 'Nicholas Mark Gotts'